澳门六合彩【挂牌】 更多»

|

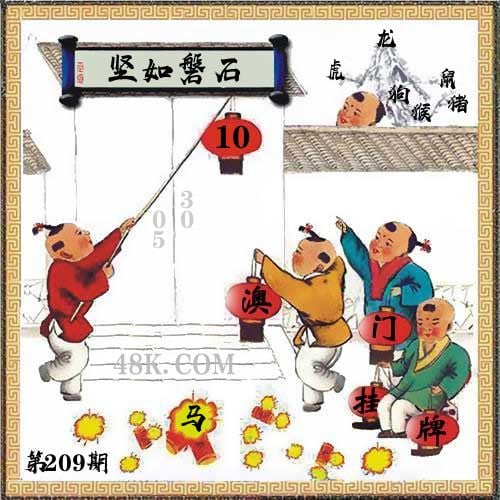

209期 | |

|---|---|---|

| 挂牌 | 10 | |

| 火烧 | 马 | |

| 横批 | 坚如磐石 | |

| 门数 | 05,03 | |

| 六肖 | 龙虎鼠狗猪猴 | |

澳门挂牌解析

2024-209期正版彩图挂:10;挂牌:坚如磐石;六肖:龙虎鼠狗猪猴;火烧:马

解析:【出自】:《玉台新咏 古诗为焦仲卿作》:“君当作磐石,妾当作蒲苇。蒲苇纫如丝,磐石无转移。”【示例】:我们伟大的祖国坚如磐石。

解释:坚:牢固;磐石:大石头。牢固得像大石头一样。形容非常坚固;不可动摇。

综合取肖:蛇牛虎羊猴狗

解析:【出自】:《玉台新咏 古诗为焦仲卿作》:“君当作磐石,妾当作蒲苇。蒲苇纫如丝,磐石无转移。”【示例】:我们伟大的祖国坚如磐石。

解释:坚:牢固;磐石:大石头。牢固得像大石头一样。形容非常坚固;不可动摇。

综合取肖:蛇牛虎羊猴狗

【正版澳彩图库】 更多»

澳门管家婆100282.com

『成语平特』

209期

成语爆平特

【洋洋得意】

开

¥00

准

206期

成语爆平特

【马到成功】

开

马11

准

204期

成语爆平特

【虎虎生威】

开

虎37

准

200期

成语爆平特

【龙飞九天】

开

龙49

准

198期

成语爆平特

【马到成功】

开

马23

准

澳门管家婆100282.com

『欲钱解特』

209期:

欲钱解特诗

开:¥00

《鼠猪虎羊发大财,本期特码出大数》

208期:

欲钱解特诗

开:牛04

《羊龙鼠猴发大财,本期特码出小数》

207期:

欲钱解特诗

开:猪18

《蛇羊虎猪发大财,本期特码出小数》

205期:

欲钱解特诗

开:牛40

《兔虎羊鸡发大财,本期特码出大数》

203期:

欲钱解特诗

开:猴45

《牛蛇鸡猪发大财,本期特码出大数》

澳彩图库心水图片资料专区

澳彩独家高手出版精料

澳彩综合全年资料大全

澳彩资料独家精准四肖

| 209期: ⑨肖 | 龙猴猪狗鸡羊牛马鼠 | ????中 |

| 209期: ⑧肖 | 龙猴猪狗鸡羊牛马 | ????中 |

| 209期: ⑦肖 | 龙猴猪狗鸡羊牛 | ????中 |

| 209期: ⑥肖 | 龙猴猪狗鸡羊 | ????中 |

| 209期: ⑤肖 | 龙猴猪狗鸡 | ????中 |

| 209期: ④肖 | 龙猴猪狗 | ????中 |

| 208期--长期跟踪,稳赚不赔! | ||

| 208期: ⑨肖 | 牛马蛇鸡龙狗羊虎猴 | 牛04中 |

| 208期: ⑧肖 | 牛马蛇鸡龙狗羊虎 | 牛04中 |

| 208期: ⑦肖 | 牛马蛇鸡龙狗羊 | 牛04中 |

| 208期: ⑥肖 | 牛马蛇鸡龙狗 | 牛04中 |

| 208期: ⑤肖 | 牛马蛇鸡龙 | 牛04中 |

| 208期: ④肖 | 牛马蛇鸡 | 牛04中 |

| 207期--长期跟踪,稳赚不赔! | ||

| 207期: ⑨肖 | 猪狗马龙蛇鸡牛兔虎 | 猪18中 |

| 207期: ⑧肖 | 猪狗马龙蛇鸡牛兔 | 猪18中 |

| 207期: ⑦肖 | 猪狗马龙蛇鸡牛 | 猪18中 |

| 207期: ⑥肖 | 猪狗马龙蛇鸡 | 猪18中 |

| 207期: ⑤肖 | 猪狗马龙蛇 | 猪18中 |

| 207期: ④肖 | 猪狗马龙 | 猪18中 |

| 206期--长期跟踪,稳赚不赔! | ||

| 206期: ⑨肖 | 蛇羊牛兔鸡虎猪鼠狗 | 兔14中 |

| 206期: ⑧肖 | 蛇羊牛兔鸡虎猪鼠 | 兔14中 |

| 206期: ⑦肖 | 蛇羊牛兔鸡虎猪 | 兔14中 |

| 206期: ⑥肖 | 蛇羊牛兔鸡虎 | 兔14中 |

| 206期: ⑤肖 | 蛇羊牛兔鸡 | 兔14中 |

| 206期: ④肖 | 蛇羊牛兔 | 兔14中 |

| 205期--长期跟踪,稳赚不赔! | ||

| 205期: ⑨肖 | 兔蛇马猪狗龙羊鸡牛 | 牛40中 |

| 205期: ⑧肖 | 兔蛇马猪狗龙羊鸡 | 牛40中 |

| 205期: ⑦肖 | 兔蛇马猪狗龙羊 | 牛40中 |

| 205期: ⑥肖 | 兔蛇马猪狗龙 | 牛40中 |

| 205期: ⑤肖 | 兔蛇马猪狗 | 牛40中 |

| 205期: ④肖 | 兔蛇马猪 | 牛40中 |

| 204期--长期跟踪,稳赚不赔! | ||

| 204期: ⑨肖 | 鼠狗牛猪龙鸡马蛇猴 | 鼠05中 |

| 204期: ⑧肖 | 鼠狗牛猪龙鸡马蛇 | 鼠05中 |

| 204期: ⑦肖 | 鼠狗牛猪龙鸡马 | 鼠05中 |

| 204期: ⑥肖 | 鼠狗牛猪龙鸡 | 鼠05中 |

| 204期: ⑤肖 | 鼠狗牛猪龙 | 鼠05中 |

| 204期: ④肖 | 鼠狗牛猪 | 鼠05中 |

| 203期--长期跟踪,稳赚不赔! | ||

| 203期: ⑨肖 | 猪马牛龙猴狗鸡羊兔 | 猴45中 |

| 203期: ⑧肖 | 猪马牛龙猴狗鸡羊 | 猴45中 |

| 203期: ⑦肖 | 猪马牛龙猴狗鸡 | 猴45中 |

| 203期: ⑥肖 | 猪马牛龙猴狗 | 猴45中 |

| 203期: ⑤肖 | 猪马牛龙猴 | 猴45中 |

| 203期: ④肖 | 猪马牛龙 | 猴45中 |